Q1 2023 Market Commentary: Are We There Yet?

Outlook

Nearly every economist is calling for a recession in the latter half of 2023 or early 2024. This is the recession that seems so obvious that everyone is preparing for it in some way. When it comes to predicting downturns, it’s more about “when”, not “if”.

There have been notable figures calling for big sell offs since 2011. Anyone who listened to that advice would’ve lost out on one of the best investing decades in the market. Compounding is a powerful component to investing and the biggest factor is time. Missing large blocks of time can be harmful to financial goals, even when markets trend down temporarily. Diversified investors will typically hold assets that pay dividends and interest to help offset some of the price fluctuations.

When there is broad consensus of a recession, much of that assumption begins to price into the markets. If current prices are already reflecting a high probability of recession, we may have already experienced the worst of the selloff in 2022. A mild recession could even be celebrated by markets as that is viewed as the “soft landing” the Fed was hoping to achieve. The point being, long-term investors should get invested and stay invested to achieve the long-term results they desire.

This information is meant to be a commentary regarding Consilio Wealth Advisors’ views on the relative attractiveness of different areas of the market, contrasted with our current asset allocation strategy for the near term, 12-18 months.

These views are always made in the context of a well-diversified portfolio and are not meant to be a recommendation to buy into or sell out of a particular area of the market. These views can and will change as new information becomes available, and we will periodically update this brief to keep you informed of changes.

Inflation

Inflation seems to have peaked and has already started a downtrend. While there could be pockets of inflation flare up, that is normal supply/demand imbalances. Currently, the issue is with eggs and avian bird flu, which is something we’ve experienced before in more normal times.

Mortgage rates briefly touched 7% which brings affordability into account and home prices have come down as a result. Auto loan rates increased for both new and used car financing, also bringing affordability into question.

Affordability for goods and services will continue to be a question mark. Higher prices and dwindling stimulus could add downward pressure on consumer demand.

Employment

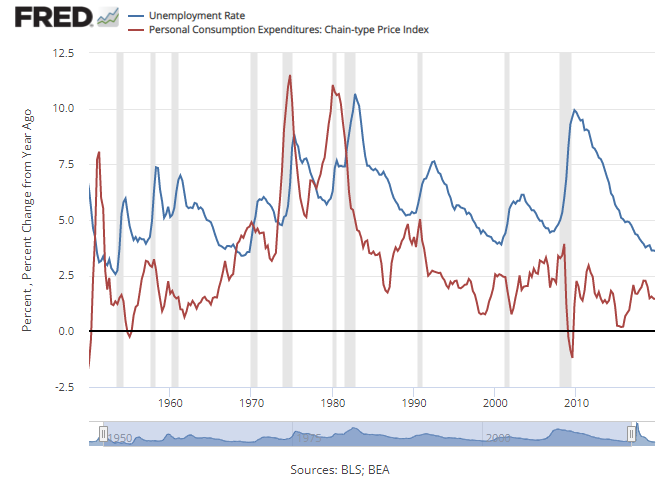

The labor market is considered “tight” meaning labor is in short supply. Anyone who wants a job can probably find one, including tech workers. The labor market does need to loosen in the Fed’s eyes because they believe low unemployment leads to higher wages which will continue to keep inflation high. Prices are higher because workers are earning more, demanding more goods and services. While this makes sense on the surface but we’ve seen that relationship breakdown over the last 40-50 years.

There are theories suggesting that the Fed is responsible for the decoupling of inflation and unemployment. They argue that stable prices over the decades have caused inflation expectations to lower, regardless of the labor market, and that’s been the biggest reason why prices don’t shoot up when unemployment goes down. We tend to believe that technology and less union representation contributed to the lack of relationship between unemployment and inflation.

Debt Ceiling

2011 was the year that the US went through a debt ceiling crisis and suffered its first credit downgrade in history. Stocks sold off by around 18% that summer but recovered to end the year up 2%. Bonds acted like bonds, which may come as surprise after suffering through 2022. Even in the face of a downgrade, bonds showed resiliency in 2011. If we get a repeat of 2011, we believe we’re in a similar position to withstand risks related to debt ceiling drama. The average 10-year treasury rate in 2011 was 2.78%. The 10 year is 3.5% to start 2023. Starting yield matters and we believe there’s sufficient cushion where bonds are expected to hold up in case of a stock market sell-off.

International

Things seem to be improving in Europe because of a mild winter that has staved off an energy crisis. Russian oil is still circulating to some countries, but Europe has been able to build its gas reserves to nearly 100%. They’ll still need a more permanent solution to replace Russian oil but this is a promising sign. We think weather patterns can change and a cold snap will eat into reserves. The market however has responded to international investments with optimism.

When Europe experienced a relatively mild winter, the MSCI EAFE index really started to outpace the S&P500. The US dollar has also started to weaken. That should benefit international companies, even if their prospects remain unchanged from here. Since October 2022, international developed assets have beaten US by 15%.

Smaller US Companies

While international has looked impressive, we still prefer US mid cap and small cap companies. Like international, these stocks have lagged the S&P500 and represent a possible opportunity. We believe this space is less prone to currency movements. For example, if the dollar strengthens again, international stocks are expected to trail. But US based small and mid-sized companies most likely have less international exposure and are less exposed to currency movements.

Rates

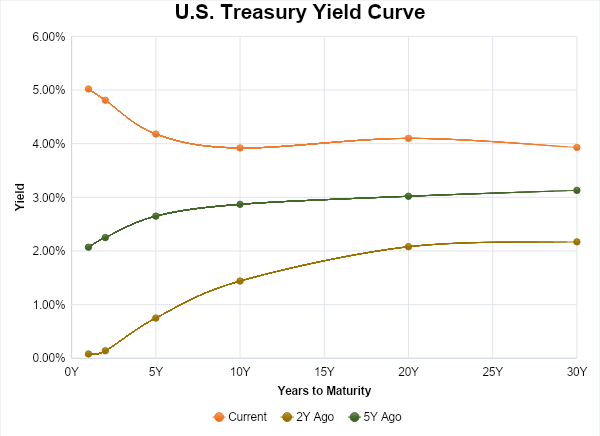

The yield curve has been inverted for an extended period and has been a signal to impending recession. An inverted yield curve means shorter maturity debt is paying more than moderate to long term debt. Banks need to pay depositors a higher savings rate than what they can earn by loaning that money out long term. If banks can’t make money on loans, then they simply won’t loan money out. This among other factors leads to economic activity slowing and potential recession.

As seen in the yield curve chart below, the green line from five years ago was more “normal”. The line from two years ago looks normal but it is showing historically low rates across the board.

Source: YCharts as of 2/28/2023

Fixed Income

After a historically bad year, we believe that bonds are poised to behave like bonds again. The difference between this year and last is the starting yield. Last year was more sensitive to rate hikes because it started at 1.5% for the 10 year treasury. This year, it’s at 3.5%. That should provide more cushion for further rate hikes.

The jumbo rate hikes could be in our rearview mirror. Barring any spikes in inflation, we think that the Fed may raise rates by 0.25% twice this year and then stop. The massive hikes were needed to catch up because the Fed was so woefully behind starting in 2021.

There are higher yields for shorter duration bonds for now. The bond market is already pricing in lower yields in 2024 so any bonds that mature this year may find it difficult to replace 4% yields.

Reducing credit exposure might be prudent in a possible recession. Typically, defaults climb when the economy slows. We believe in reducing exposure to high yield and lower grade credit. Additionally, look to limit exposure to other types of credit like credit card and auto loans.

Summary

What we’re trying to maximize is the probability of long-term success. If an investor jumps in and out of the market trying to avoid the most obvious recession, there may still be upside missed or we don’t get a recession until much later. Or the market already priced in a recession and an official stamp only confirms it. There’s a chance the market responds positively. If last year were any indication, market reactions to good or bad news are unpredictable.

If inflation continues to surprise to the downside, like it has lately, that good news should price into the markets. Consumer and businesses spending are both slowing. If we’re to see another spike in inflation, it would be in specific areas where there’s a supply crimp or outsized demand.

Look for us to start adding longer duration treasury bonds to the portfolios. In case consensus is right, a recession could still cause a stock market sell off. The corresponding move out of risk assets has historically been to US treasuries. In spite of the debt ceiling drama, US government debt is still the preferred asset in the world.

In addition, we are looking to reduce some of our value tilts and migrate moderately towards growth. We think the Fed is closer to being done with rate hikes and there will be opportunities for growth companies to rebound after a tough 2022.

DISCLOSURES:

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

This document is for your private and confidential use only, and not intended for broad usage or dissemination.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. The principal risks of CWA strategies are disclosed in the publicly available Form ADV Part 2A.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. You cannot invest directly in an Index.

Past performance shown is not indicative of future results, which could differ substantially.

Consilio Wealth Advisors, LLC (“CWA”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where CWA and its representatives are properly licensed or exempt from licensure.