Q2 2023 Market Commentary: “Recession or Not, We Don’t Care” – The Market

This information is meant to be a commentary regarding Consilio Wealth Advisors’ views on the relative attractiveness of different areas of the market, contrasted with our current asset allocation strategy for the near term, 12-18 months.

These views are always made in the context of a well-diversified portfolio and are not meant to be a recommendation to buy into or sell out of a particular area of the market. These views can and will change as new information becomes available, and we will periodically update this brief to keep you informed of changes.

Outlook

Through June 8th, the S&P 500 has increased by 12.6%, but the headlines suggest that we are still in a bear market. Although inflation is cooling, it is still uncomfortably high, Russia is still at war with Ukraine, OPEC has cut oil production, and several regional banks have failed. The Fed's rapid rate hiking regime has caused credit to slow down, but the consumer keeps spending.

Despite all of this, the Nasdaq is technically in a bull market, up 36.5% since December 28th, 2022 through June 8th, 2023. Big tech companies such as Microsoft, Apple, Nvidia, and Meta are leading both the S&P 500 and the Nasdaq.

It is assumed that something will break from the Fed's hiking policy. The markets briefly reacted to the collapse of Silicon Valley Bank (SVB), but proceeded to push higher. No one predicted the collapse of SVB because it was commonly believed that banks were in great shape post-pandemic. Banks are indeed in great shape when it comes to loans, but it is their portfolio of bond assets that are coming under scrutiny. It is hard to survive a bank run, and you must liquidate assets at a loss.

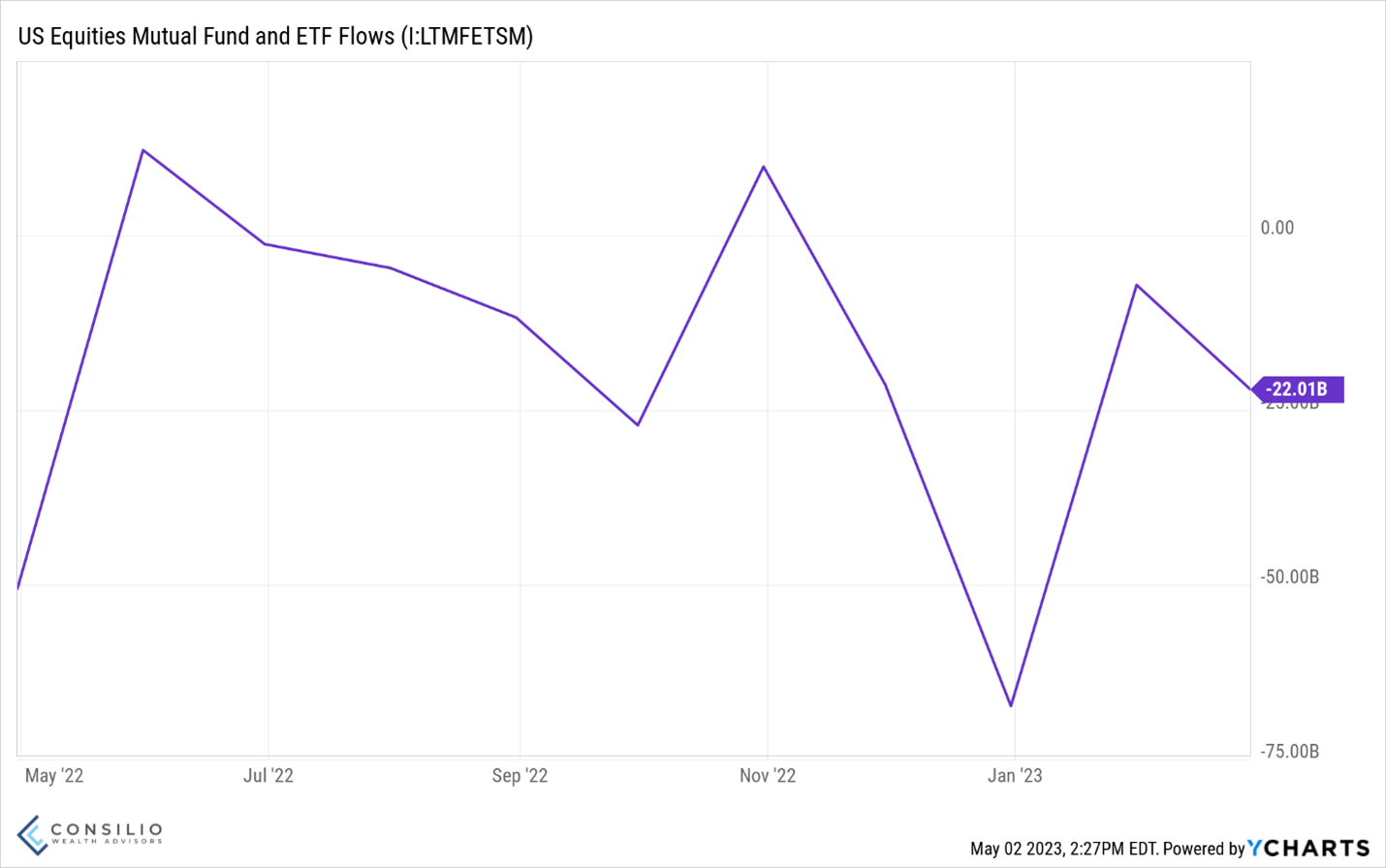

Fear still exists in today's market as we have seen money flow out of equity and bond funds.

We are dubbing this "the most obvious recession ever" because, fundamentally, economists believe one is coming. But what’s that saying? The media has accurately predicted 20 of the last 10 recessions. Something like that...

Consumer Confidence

There is plenty of evidence to suggest that we will get one. However, we are not currently in a recession, and no one can pinpoint when it will happen. Consumer confidence is lower than it was in 2008 and lower than in 2020. It is lower than the last spell of inflation of the 70's and early 80's. To put the data into context, the unemployment rate is 3.5%, and GDP is positive at 1.1%. So far, the recession is only in our heads. It does not mean that it will not eventually come true, but to have less confidence now compared to 2008 doesn’t make sense.

It’s worth noting that investing during periods of low consumer confidence has produced positive returns (over the next 12 months) in 8 out of 8 years, and an average of +25%. This far exceeds investing during periods of very strong consumer confidence, but those are also positive at +3.5% over the last 5 of 9 years.

Recession and Debt Ceiling

While we do think a mild recession is likely, it will likely not be a credit crunch like the one experienced in 2009. Those types of recessions have historically been much more severe and typically take longer to recover from. We understand that no two recessions are the same but if we’re going to compare this potential one to another one, it would be the recession of the early 90’s. That recession began in July 1990 and ended in March 1991. While the recession lasted about 9 months, the stock market recovered in 7 months.

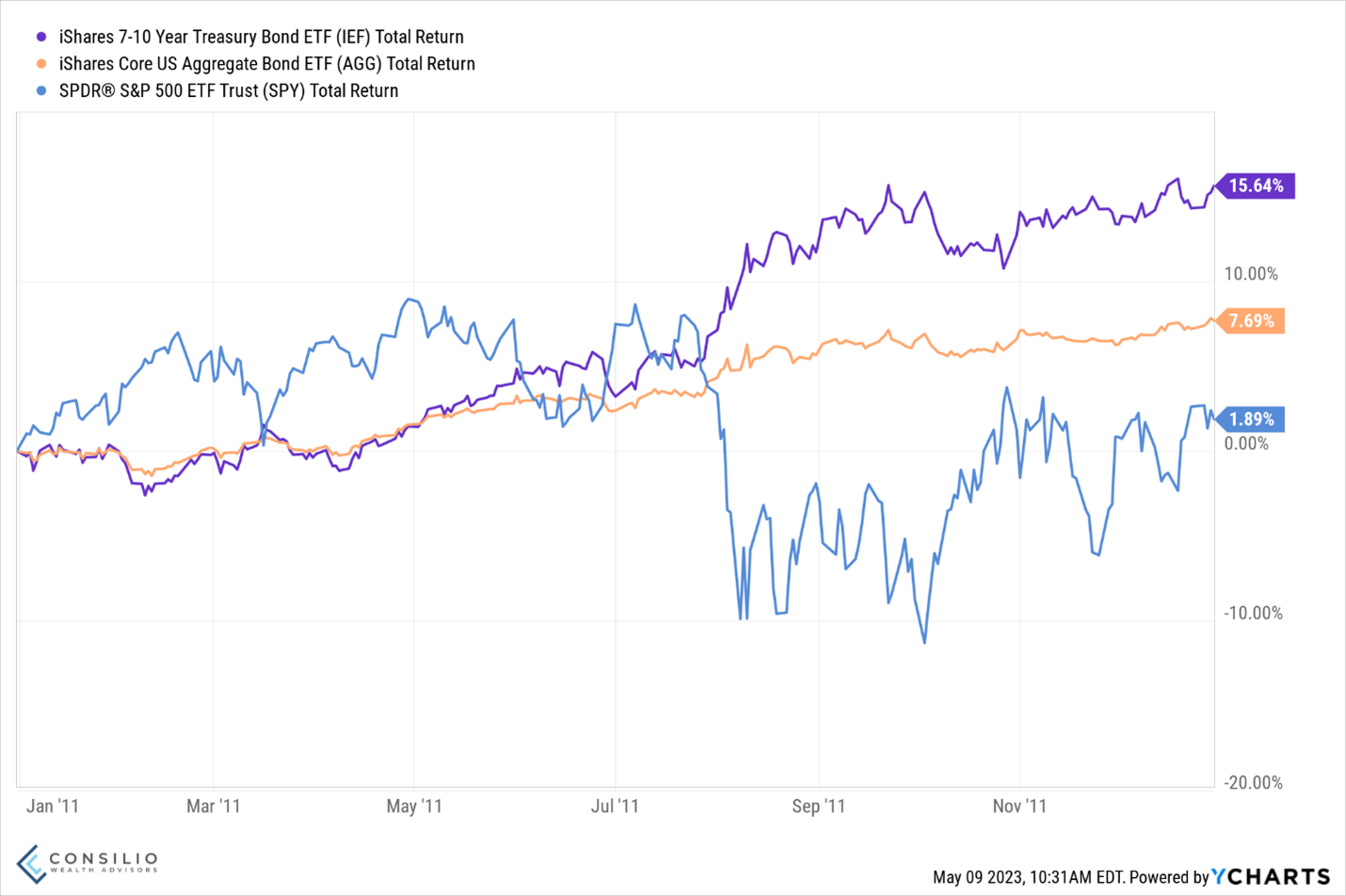

Another risk was the debt ceiling, which is close to being resolved by the early June deadline. The last debt ceiling debate was in 2011. US debt was downgraded, and the markets responded by buying more US debt. What? 7-10 year treasuries were up 15.64% in 2011 while stocks were down ~16% off their previous highs but recovered by year end.

With all these known risks, the natural question would be why we’re still fully invested. For long term investors -of which, we all are, at least to a degree with a portion of our portfolio- this will ultimately look like a blip. For short-term investors, timing the market is difficult. Few investors saw the blue-chip technology rally coming this year. If the market sells off, there’s no guarantee that these companies will test their 2022 lows again. You don’t get yesterday’s price.

There will always be unknown risks that will shake the markets. The problem is they’re unknown and it’s hard to prepare for something so uncertain. Another way to look at it is the bad news being priced in may end up bad - but not as bad as expected . This happens all the time, we assume the worst but reality isn’t nearly as bad.

Let’s not forget that politicians own and actively trade stocks too. Whether you think this is right or wrong, politicians still have their own interests. If they want to grandstand to prove some point, their pockets will get lighter. We don’t think anyone wants a US default, but we should be mentally prepared for one to happen.

Summary

A lot of the known risks are already priced in which means the market is anticipating them. At least investors have acted with the information that is widely available. Everyone knows about the debt ceiling and possible recession. How much of it is priced in is unknown but we should assume that the markets have already considered these two risks.

The stock market can go up even when investors are pulling money out of funds because stock fund flows are not the only factor that affects stock prices. The stock market is influenced by a wide range of factors, including corporate earnings, economic data, geopolitical events, and changes in monetary policy.

For example, if a company reports better-than-expected earnings, it can cause investors to become more optimistic about the company's future prospects and drive up the stock price. Similarly, if economic data such as job growth or consumer spending is stronger than expected, it can boost investor confidence and lead to higher stock prices.

In addition, there are many different types of investors who participate in the stock market, including institutional investors, individual investors, and algorithmic traders. Each of these groups can have a different investment strategy and time horizon, which can influence their buying and selling decisions.

In our last newsletter, we noted our international and emerging markets underweights because we would rather use our risk capital for US mid and small companies. It’s only been three months but we want to reiterate our positioning and not make any changes for now. China carries an oversized position in nearly all emerging market funds and it has shown increasing government overreach which is keeping pressure on Chinese companies.

Interest rates have been highly volatile as the market is making predictions about where the Fed is heading. The market dictates rates for anything that’s 2 days long to 30 years long. The Fed can only change the overnight lending rate, which still has large implications for banking. The global investment pool continues to buy quality bonds at any sign of fear which has kept the 10-year US Treasury rate at ~3.5%. For comparison, the overnight rate is ~5%.

DISCLOSURES:

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

This document is for your private and confidential use only, and not intended for broad usage or dissemination.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. The principal risks of CWA strategies are disclosed in the publicly available Form ADV Part 2A.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. You cannot invest directly in an Index.

Past performance shown is not indicative of future results, which could differ substantially.

Consilio Wealth Advisors, LLC (“CWA”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where CWA and its representatives are properly licensed or exempt from licensure.