Q4 2023 Market Commentary: King Dollar and Its Royal Subjects

This information is meant to be a commentary regarding Consilio Wealth Advisors’ views on the relative attractiveness of different areas of the market, contrasted with our current asset allocation strategy for the near term, 12-18 months.

These views are always made in the context of a well-diversified portfolio and are not meant to be a recommendation to buy into or sell out of a particular area of the market. These views can and will change as new information becomes available, and we will periodically update this brief to keep you informed of changes.

King Dollar and Cash is King (For Now)

News of the dollar’s demise is greatly exaggerated. Brazil, Russia, India, China, and South Africa (BRICS) have attempted to create a new currency to try to dethrone the US Dollar. Doubters of US Dollar strength rightfully point to the federal debt and downgrade of US credit as reasons for weakness. But they conveniently ignore that the BRICS economies are all developing and are more susceptible to currency crises compared to developing countries. Just because they’re looking to combine forces, it doesn’t establish an elevated sense of credibility in their currencies. Russia’s currency strengthened since Ukraine, due to the lack of trade partners, not because Russia’s economy is strong. China is a known currency manipulator where the government has artificially kept the yuan weak to boost Chinese exports. India is fighting money laundering and is going through a money crisis, as it looks to reduce the amount of paper rupees in circulation.

Being the world’s reserve currency requires stability and the BRICS countries are decades away from achieving developed market status. Even with all the warts that the US has, the dollar still has a long way to devolve before losing its status as the world’s reserve currency. Post Covid, can you identify a country that has reopened as successfully as the US? I’ll wait…

The Federal Reserve has also been the most aggressive central bank in raising rates. While the hikes were painful, they have helped strengthen the dollar relative to other currencies. Japan’s central bank is currently engaging in yield curve control with rates at -.01%. That’s not a typo. Japan’s interest rates are negative. A negative interest rate will erode any savings sitting in a Japanese bank. After years of deflation, Japan is desperate to grow their economy and achieve some level of inflation.

Now look at what currency is more attractive. The US dollar earning +5% or the Japanese yen losing -.01%. That imbalance is attracting investment to the US dollar relative to the Japanese yen. It’s a dynamic occurring with the US and Europe too. The European Central Bank has hiked rates but not as aggressively as the US. As a result, the US dollar is trading $.95 for €1 to the euro. That’s a level not seen since the early 2000s. This is great news for US tourists travelling abroad. Not so great for US companies selling abroad. Currency strength cuts both ways.

Coincidentally, the euro and Japanese yen are world’s other reserve currencies. For the BRICS countries to have any hope, they’ll need to surpass Europe and Japan first, then to have a shot at the US.

The rise in interest rates caused pain for equities & bonds last year but is now offering opportunity to savers. Money markets and certificates of deposits (CDs) are offering yields 5.0%+, not seen since 2007. There’s suddenly a safe way to earn healthy interest rates on our money.

As in the chart above, the short-term interest rates don’t normally stay high. Rates tend to drop in response to a slowing economy or recession. Despite many predictions to start the year, there has been no recession yet. In response, the Fed needs to keep rates higher for longer to slow spending. Their target neutral rate is 3%-3.5%.

We caution against overdoing with cash investments because these high interest rates aren’t expected to last. The Fed itself is forecasting rate cuts within two years. We couldn’t be happier for clients earning more than 5% on their cash. The appeal of this safe money hasn’t been higher in over a decade so it’s tempting to overdo it.

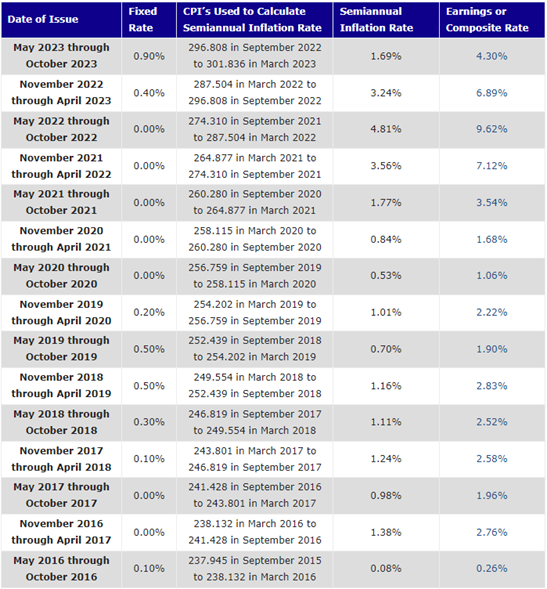

Series I bonds were one of the most popular investments of 2022, and lost their luster in a relatively short amount of time. We mentioned them as a viable investment in late 2021. In less than two years, the yield on the investment has continued to shrink as inflation rates have come down. They were all the rage when bond markets were nearly 10% down and interest rates were still historically low. They’re now yielding 4.3%, which is much lower than current CD rates. The chart below shows the recent history of I bonds. We’ve had stubbornly low inflation pre-pandemic and the yields hovered around 2%.

The Series I bonds were worth the effort when they were offering double digit rates. Even slogging through the Treasury Direct website wasn’t enough to stop people trying to get these bonds hand over fist. If it wasn’t for that pesky $10,000 cap. We reminded everyone that those rates would only stay high if inflation continued to rise.

Rates sensitive to short term movements are fleeting because rates are always moving. While they could be a great component to an investment portfolio, they are rarely the silver bullet that investors always look for. No single investment is the perfect investment. Diversified portfolios help reduce that imperfectness.

Investing in CDs and money markets provides temporary yield, forcing investors to play the game of constantly trying to find a home for your money. Rates may come down faster than you expect, and it will be another scramble to find where to invest that money. Money market investments will see their yields go down the fastest, followed by CDs. These investments are short term in nature. When a CD matures, customers get their money back but now need to funnel it back into another CD. When rates are lower, turning these CDs over will yield less. This is called “reinvestment risk”. It’s great for short term cash but raises concerns for long term money.

US Stock Market

Heading into this year, the case for stocks was rough. The major indices were down more than 18% and the bond index was down more than 13%. There wasn’t a lot of hope.

Even after successive down months, we’re still up for the year. The bond market has shown resiliency even though rates have continued to move upward.

There could be seasonality in this year’s performance. September has historically been the worst performing month going back to 1945.

This August and this September had good reasons to sell off. The big three automakers are currently mired in a striking workforce. The Fed announced at least one more hike this year. And congress can’t agree on a budget risking a government shutdown.

The UAW announced strikes at Ford, GM, and Stellantis plants. As of this writing, there’s no resolution but it looks like Ford might be the closest to finding common ground. On Episode 33 of our podcast, we discussed some of the strategies that UAW has taken to highlight CEO pay and targeted strikes. Listen here.

Inflation still looks persistent in the services sector. We’ve seen the price of goods come down but industries with higher labor inputs are seeing inflation remain persistent. The Fed will want to be ahead of this and will raise rates at least once more this year. If inflation doesn’t come down, expect rates to be higher for longer. The expectation of higher rates is currently being priced into the market, though the Fed hasn’t raised rates. This is strengthening the dollar as other countries haven’t raised rates as quickly or have other economic issues of their own.

Government shutdowns are nothing new to the US and have had mixed responses from the market so take the headline risk with a grain of salt. We would still have a functioning federal government, it’s just a barebones form that will keep the country going. (You guessed it! On the podcast)

A shutdown would delay the release of vitally important inflation reports. If the Fed doesn’t have access to these, they could be flying blind. More so than they have already.

Keen-eyed readers will probably see that October, November, and December are historically the better performing months. Lots of bad news seems to wait until our kids go back to school. History doesn’t repeat itself, but it does rhyme.

Emerging Markets

Emerging markets, particularly China, continue to give us reasons to turn up our nose towards the investment. China’s over construction of residential housing is finally coming back to haunt them. Evergrande is the poster child for China’s real estate implosion. There are millions of unsold and uninhabited units. The Chinese government is most likely on the hook for the bankruptcy which trickles down to the citizens. The government has already provided support to several developers who have fallen under financial pressures.

If it’s not real estate, it seems to be always something with China. Over regulation, government overreach, human rights violations. Though we do see depressed valuations, it’s with good reason. As a result, we are further reducing our allocation to emerging markets, which China is the biggest exposure. We will still have interests in emerging regions, such as India and South America. The risks with China seems to outweigh reward.

We are moving our direct investment in EM to US large cap (S&P500) and adding an alternative investment. Emerging markets still offered diversification and we wanted to preserve some diversification in the portfolios. Though the US has been king, there’s been long stretches where the US wasn’t. Think 1950-1980.

Diversification was the key reason to hold emerging markets in a portfolio but risk/reward is also a consideration. Emerging market investments provided good diversification last year and this year. When the dollar strengthens, exports from emerging market countries go up because their products are relatively cheaper for US consumers. Weighing those benefits to the risks mentioned with China, we felt that it was time to explore other assets that achieve the same diversification benefit with better potential reward.

40% of total revenue generated from S&P500 companies comes from overseas. So, reducing international exposure still leaves investors with indirect exposure. Nearly all the companies in the S&P500 sell in more than one country, it’s really a matter of how deep that exposure is.

Outlook

With the Republican primary debates happening, we’re reminded of the looming election year and the dreadful news cycle. There’s going to be a lot of chirping about this candidate or the state of the country. Now is a great time to remind you that this is all noise and it’s best to ignore it when it comes to investment decisions. A candidate making wild promises during a debate won’t impact the economy one way or another. Even a sitting president doesn’t carry that much economic power. No matter how toxic the rhetoric will be in the coming year, none of it will make a difference.

The chart counts the election year, not the actual year of the new presidential term. Presidents and presidential candidates have little to no impact on the economy. Their lack of economic power in an election year is more pronounced. In many cases, policy shifts are limited because neither party does not want to risk their electability.

Election years generally bring on more market volatility but they are mostly positive years. The performance is random whether a Republican or Democrat wins election in November. The economic undercurrents are more of a predictor than which party wins.

DISCLOSURES:

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

This document is for your private and confidential use only, and not intended for broad usage or dissemination.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. The principal risks of CWA strategies are disclosed in the publicly available Form ADV Part 2A.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. You cannot invest directly in an Index.

Past performance shown is not indicative of future results, which could differ substantially.

Consilio Wealth Advisors, LLC (“CWA”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where CWA and its representatives are properly licensed or exempt from licensure.