Q1 2024 Market Commentary: An Unexpectedly Great Year and Convincing Ourselves It Wasn’t

This information is meant to be a commentary regarding Consilio Wealth Advisors’ views on the relative attractiveness of different areas of the market, contrasted with our current asset allocation strategy for the near term, 12-18 months.

These views are always made in the context of a well-diversified portfolio and are not meant to be a recommendation to buy into or sell out of a particular area of the market. These views can and will change as new information becomes available, and we will periodically update this brief to keep you informed of changes.

Year In Review

The S&P500 was up over 26% last year, despite plenty of pessimistic views heading in.

There were serious questions about inflation and the Fed’s fight against it. By raising rates as quickly as they did, from .08% to 5.33% across 11 rate hikes, the risk of recession went up. The hiking cycle started in March 2022 and ended in July 2023. Everyone saw the recession coming. Except that it didn’t happen.

When the expected recession didn’t happen, markets rallied. Using hindsight, it looks like 2022 was the year that priced in recession. When lowered expectations aren’t met, in this case to the upside, then the market reacts in kind.

Japan’s stock market continues its leadership with a flat 2022 and a very good 2023. Japan had been widely overlooked due to their flat market over the last 30 years. Maybe it’s a consolation prize for everyone who says stick to international, specifically Japan.

The Bank of Japan (BOJ) remains committed to its ultra-loose monetary policy, which has weakened the yen. A weaker yen makes Japanese exports are more competitive and boosts the earnings of exporters when repatriated into yen. This attracts investors seeking to benefit from currency movements.

Most of the other asset classes clawed back what was lost in 2022, except China, which finished 2023 down -11% after a -22% return in 2022.

The Catch-Up Rally

A "catch-up rally" is a situation where certain assets or sectors that have previously underperformed relative to others suddenly experience a rapid increase in price or value, bringing them closer to the level of the outperformers. It's a period of playing catch-up for the laggards.

In 2023, it was the year of the Magnificent 7, or blue-chip tech names. The rest of the market was mostly treading water until November when the rally started to broaden out.

The S&P500 has led for most of the year and finished up just over +26%. The Russell 2000 (small-cap stocks) and the Russell Mid-Cap indexes have largely been flat until late Q4 2023.

The gap between the S&P500 was large compared to nearly every other asset class up until November. Any investment that didn’t have the exposure to the Magnificent 7 that the S&P500 and Nasdaq indexes did, underperformed.

But things can turn around quickly.

In late Q4 2023 the Fed surprised the markets by forecasting at least three rate cuts in 2024. As markets are prone to do, it started pricing in the expectation of next year’s rate cuts. The S&P500 benefited but small and mid-cap stocks were uncorked. Unloved for much of the year, small-caps went up over 24% in less than two months. It’s a lesson to continue to hold everything, even through rough times.

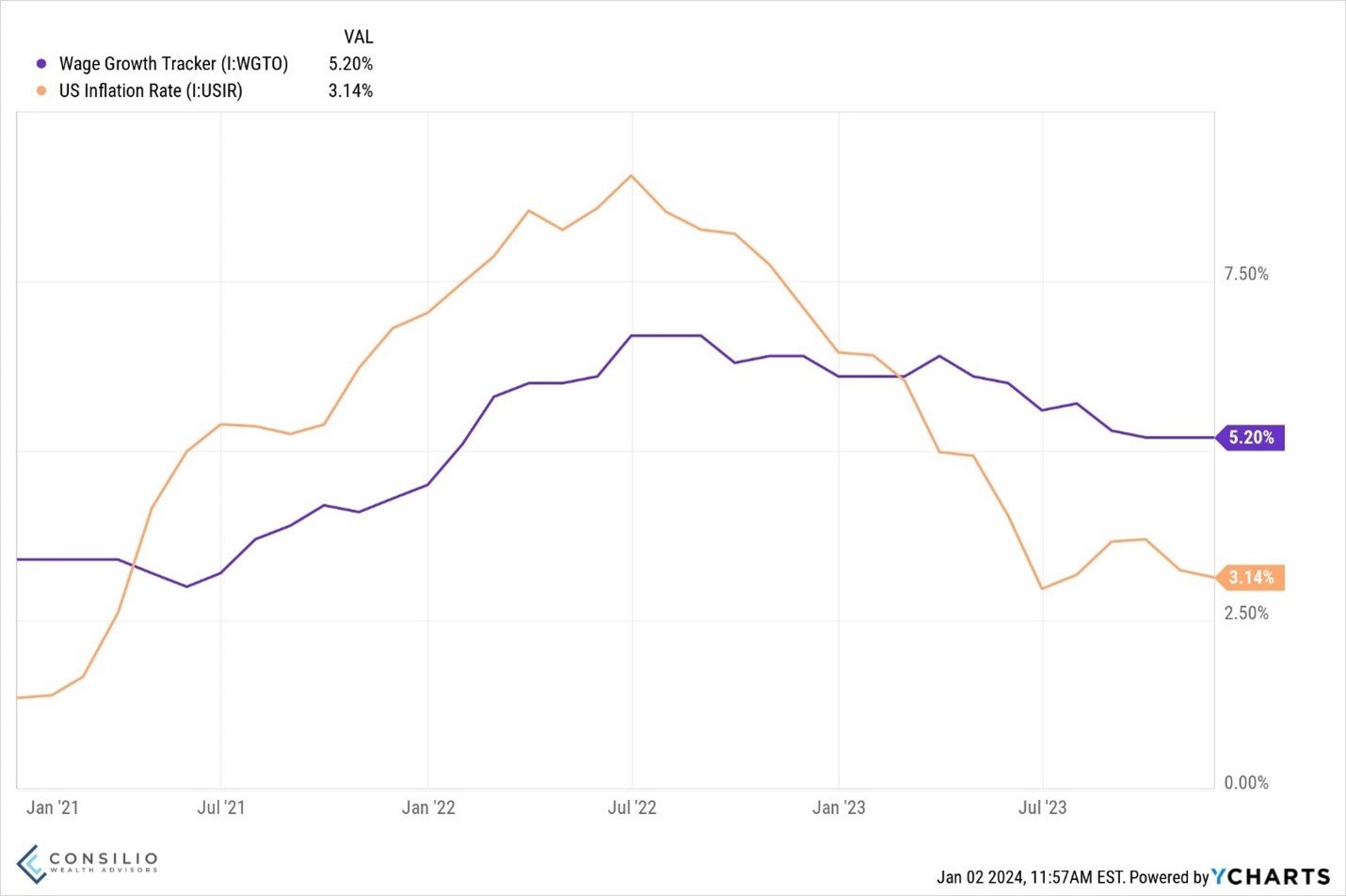

Inflation and Wage Growth

Wage gains have slowed but have started to exceed the rate of inflation now that inflation has dropped. Quite a positive shift as consumers should start to feel their paychecks are getting ahead of prices.

This might have been one of the biggest factors driving consumer sentiment. Even though people got raises, they felt they weren’t getting ahead because everything was more expensive. Now that prices have moderated a little, the wage gains feel more positive.

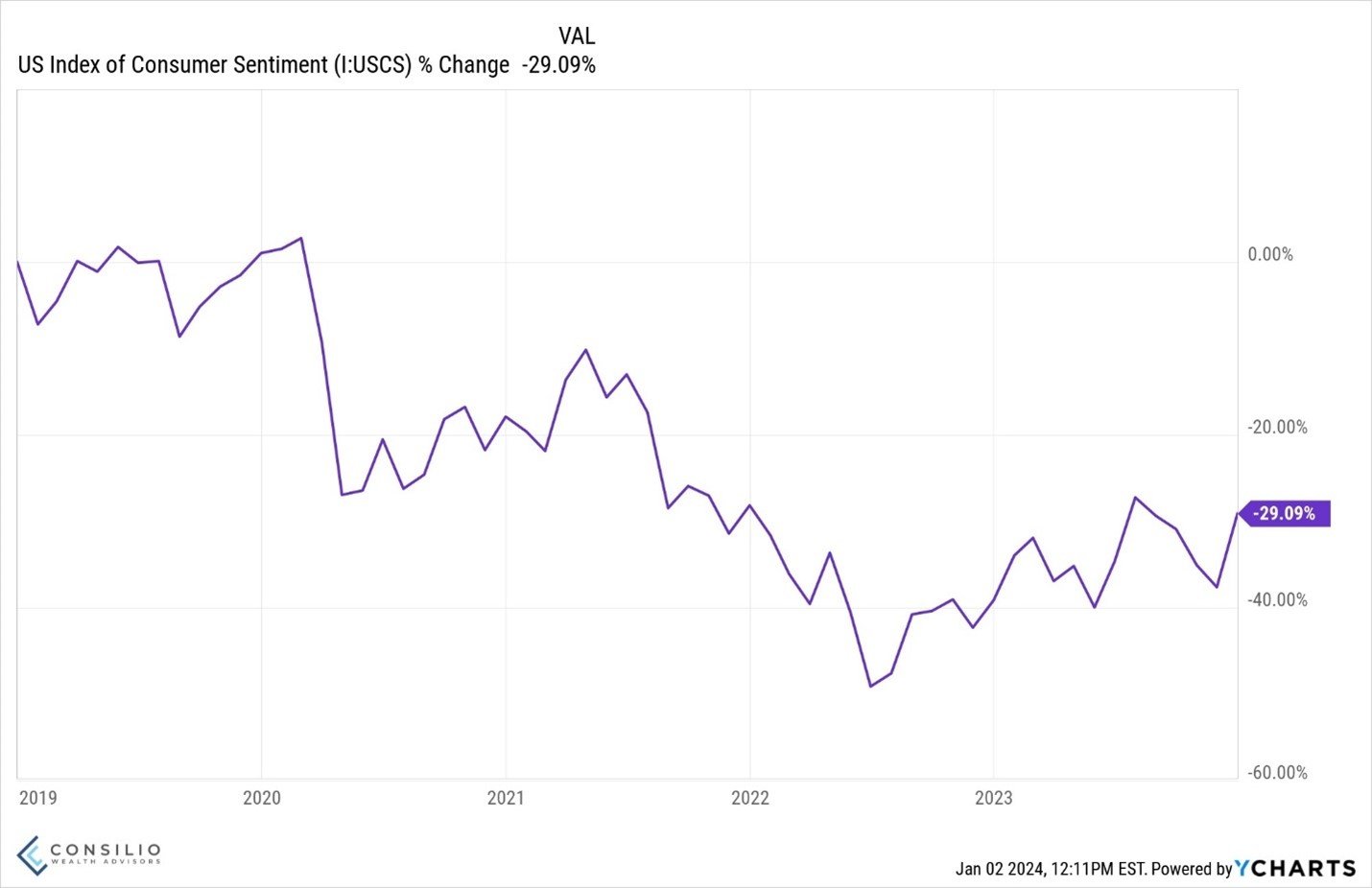

Sentiment is turning around but it’s way off from the pre-pandemic highs. If you’re curious, here are the categories used to measure consumer sentiment readings.

Current Economic Conditions:

Perceptions of the current economic climate: Are consumers optimistic or pessimistic about the current state of the economy? How do they feel about job security, income levels, and overall economic stability?

Expectations for future economic conditions: How optimistic are consumers about the future of the economy? Do they expect their own financial situation to improve or worsen?

Personal Financial Situation:

Satisfaction with current income and financial security: Are consumers feeling comfortable with their current income and debt levels? Do they feel financially secure or worried about making ends meet?

Willingness to spend and invest: Are consumers feeling confident enough to spend money on discretionary items or make new investments? Or are they opting to save or cut back on spending due to financial concerns?

Future Purchasing Plans:

Intention to make major purchases: Are consumers planning to buy big-ticket items like cars, appliances, or houses in the near future? This can indicate their confidence in the economy and their own financial situation.

Overall spending behavior: Are consumers planning to increase, decrease, or maintain their current spending levels? This can be a good indicator of overall economic activity and consumer demand.

Outlook

A December 2023 survey by the National Association for Business Economics found only 24% of respondents considered a recession in 2024 more likely than not. That’s a stark turnaround from the start of 2023 where nearly everyone was calling for recession.

Historically, inflation has never cooled without a recession. That logic makes sense: when the economy slows, demand slows as jobs become more scarce. It didn’t play out that way, at least not yet.

Though economists have been consistently wrong in predicting the future, it doesn’t lessen their merit. No one can predict the future and any surprises are met with either optimism or pessimism. There will be something (good or bad) that will shake the markets, we won’t see it coming, these things are often only obvious in hindsight.

While the market got an “all clear” from the recession front, there will be lots of reasons to not invest in 2024. It is a presidential election year after all. There’s going to be rhetoric about how crummy the economy is and how expensive everything is. While individual investors might agree with the poor sentiment, the market doesn’t care what they think.

No one felt good about the economy last year, yet the market was up over 25%. What does that tell you about feelings and market performance?

Rates

If the Fed is going to live up to its own forecasts, rates will be lower for cash savings. It’ll be much easier to move money out of a money market fund, but the conundrum will be where to park excess cash. CDs bought last year will likely mature when rates are lower. Riskless opportunities don’t last forever (see Series I Bonds) and lower rates could cause excess cash to take on more risk. This might involve reaching for yield or even shifting towards stocks.

Being over reliant on cash creates this very issue. I get that it’s a low-risk issue but the time it takes to research the next best thing might not be worth it. Let’s not forget the opportunity cost of not being invested versus looking around for a cash investment that will pay 4% versus 5%.

Lower rates could create opportunities in other areas like real estate. 30-year fixed rates have dropped recently to 6.5%, with lower rates expected in the year. Homeowners have been hesitant to trade in their 3% mortgages for an 8% rate, for good reason. I’m not sure what rates need to fall to before the housing market starts to loosen, but this is a positive direction.

So, do we know where the market might end up by year end? It’s anyone’s guess. If 2023 proved anything, it is that we don’t know. Forecasts are initially more positive to start this year, but we all know they’ll end up being wrong.

Stay diversified and stay invested. That’ll give you a high probability of a favorable investment outcome over the long term.

DISCLOSURES:

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

This document is for your private and confidential use only, and not intended for broad usage or dissemination.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. The principal risks of CWA strategies are disclosed in the publicly available Form ADV Part 2A.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. You cannot invest directly in an Index.

Past performance shown is not indicative of future results, which could differ substantially.

Consilio Wealth Advisors, LLC (“CWA”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where CWA and its representatives are properly licensed or exempt from licensure.