Q2 2024 Market Commentary: AI Winners Stand Out from the Losers

This information is meant to be a commentary regarding Consilio Wealth Advisors’ views on the relative attractiveness of different areas of the market, contrasted with our current asset allocation strategy for the near term, 12-18 months.

These views are always made in the context of a well-diversified portfolio and are not meant to be a recommendation to buy into or sell out of a particular area of the market. These views can and will change as new information becomes available, and we will periodically update this brief to keep you informed of changes.

The Early Year Review

Heading into the year, the market priced in six cuts ahead of the Fed despite the Fed saying it will cut only two times. That meant rates in the future were priced at least 1.5% lower than where rates are today. When it became clear that the Fed was not going to aggressively cut rates, the Futures market started pulling back those rate cut assumptions.

Yes, there’s a marketplace called the Futures market making assumptions on where rates are headed. Investors can look at rate cut or rate hike probabilities using the CME Tool. Futures traders can lock in rates set in the future. Those trades can move rate hike expectations up or down.

Below is an example of the most recent March Fed decision. There’s was a 95% probability that the Fed will keep rates unchanged, as of this writing.

The chart says there’s a 5% chance of a cut. While those are low odds, there’s still a chance the Fed could surprise everyone and announce a cut. Economic strength would have to erode quickly or something worrisome would have to break.

With the economy on firm footing, there’s little reason for futures traders to expect lower rates. Those expectations may change with geopolitical crises, recessions, inflation, or really anything. The futures market can get ahead of itself, like this year pricing in an overoptimistic six cuts.

The lack of expected rate cuts is great news for fixed income investors. The focus should be on yields, not bond values, which is a more sustainable expectation of returns.

The economy is still stubbornly strong in the Fed’s eyes. Unemployment stands at 3.8% which could be driving wage growth of 4.2%. For context, the 50 year average for wage growth is 3.9%. We want wages to consistently outpace the rate of inflation. Over the last two years, inflation had been higher than wage growth, a trend that recently reversed. While we are experiencing slightly higher than average wage growth (3.9% average), inflation is still trending down. It’s that last mile the Fed is having trouble with. Core PCE inflation is 2.8% with the Fed target at 2.0%. (PCE is the inflation measure which accounts for actual spending stripping out food and energy. If we reintroduce food and energy, PCE inflation is 2.4%, lower than 2.8%. The biggest drag is the drop in oil prices compared to last year.) We still think the Fed won’t cut rates this year unless there’s an unforeseen reason to.

Interest rates have broadly moved higher to start the year and despite that, the S&P500 is up nearly 7% as of early March. The positive performance can be linked to a good earnings season, especially from AI related tech companies.

Call it ego or whatever you want but the Fed has a legacy to protect. They don’t want to be known as the regime who lowered rates prematurely and experience inflation reignite. Short term pain is going to be preferable to a dragged-out inflation fight. Remember the 1970s. The Fed then cut rates prematurely and inflation was an issue for a better part of a decade. It got so bad that interest rates needed to go up to nearly 20% to finally crush it.

AI Winners and Losers

It’s Nvidia’s world and we’re just living in it. The AI revolution requires a lot of upfront investment and Sam Altman estimates $7 trillion is needed. This means increased computing power and storage. Nvidia is one of the biggest beneficiaries supplying who needs upgraded Graphics Processing Units to run generative AI applications.

No matter who wins the AI race, it’s likely Nvidia will be the main supplier to both winners and losers. At least for now.

During the California gold rush, it wasn’t the miners who struck it rich. Levi Strauss sold work pants and overalls to miners. That initial success eventually evolved into the famous blue jeans that are still popular with dads who love to buy pants at Costco (me). Sam Brannan, who is credited with starting the gold rush, didn’t mine for gold. He instead bought up all the mining equipment and resold it to prospectors. I don’t think it’s a coincidence that the person who stood to make lots of money selling pick axes was the one hyping about how mining for gold would make you rich.

In a similar vein to Brannan, Nvidia has been very vocal about how AI will make investors rich.

Microsoft is in the lead of the AI horserace with ChatGPT underpinning most of the offering. They’ve been successful so far with public launches while taking a looser approach compared to Google. This could have consequences down the line with people looking closer at potential election interference and vulgar material.

At this moment, Google looks like a loser. Really dropping the ball with the release of Gemini’s image generation AI. They enforced predefined rules that conflicted with historical accuracy. For example, users would ask the AI to generate pictures of Nazis in World War II, only to get pictures of native American women in Nazi uniforms. Gemini image creator has been since pulled while Google works out the issues.

CoPilot however has fewer guardrails and the output can be pretty offensive. If not constantly refined, the outputs could end up being embarrassing for Microsoft. Consider Twitter under Elon Musk’s watch. He removed many of the guardrails and that has led to an exodus of advertising dollars.

No matter who wins, Nvidia still supplied both sides and will still benefit from AI growth until another competitor enters the picture.

Outlook

We continue to think that rates will bounce around as the Futures market adds or removes rate cuts. All this activity can occur despite the Fed stating there will be no cuts for the time being. Just because the Fed says something, it won’t prevent markets from trying to get ahead of the Fed. Again, we think bondholders would want higher rates for longer.

If you believe that any technology will the biggest winner in the near and distant future, it wouldn’t be crazy to think those future suppliers would stand the benefit most. It wouldn’t matter if the future is AI, or mixed reality, or crypto, or something else. All technologies need increased processing and storage. Nvidia may see increased competition but it can take years to build viable chip production, just ask Intel.

Small and mid-cap companies are still showing compelling value relative to the S&P500. Over the last three years, the S&P500 is up 25% while mid-cap companies are up 6%. Small-cap companies have lagged with -10% over the same period.

Parts of the market may look expensive, but investors don’t have to look to hard to find relative value.

Japan

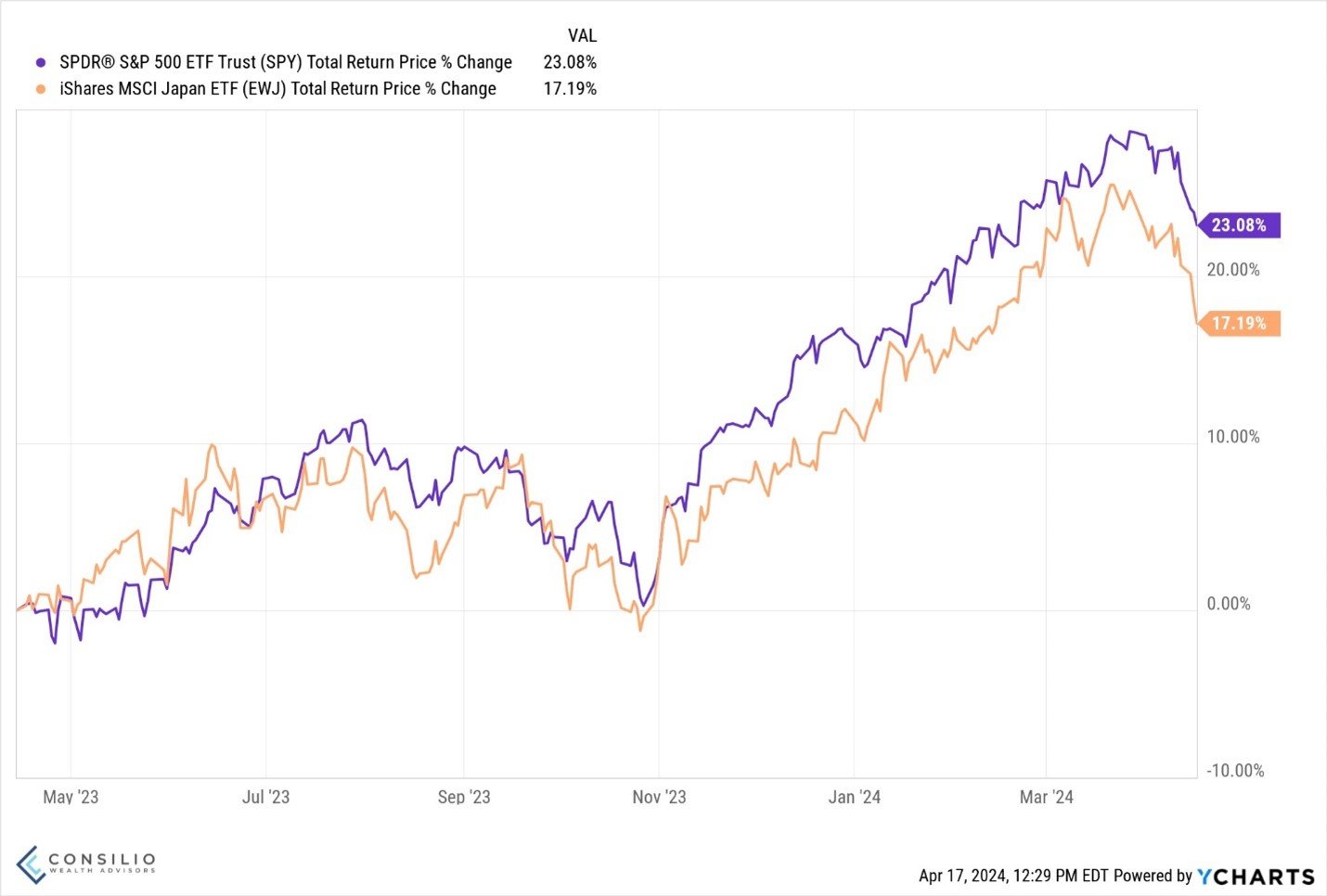

Japan’s central bank still has its foot on the gas with easy money policies. They too have an inflation target of 2%, a figure they’ve failed to meet in over 20 years. They are now experiencing inflation at 2.5% and will try to keep it above 2% for the time being. The easy money policy has helped boost exports and invited tourism as the yen has been weakened relative to other countries. This has been a boon for their stock market.

Japanese demographics still show a declining population. To keep the economy steady, they’ve introduced work visas for foreigners wishing to stay up to six months. It is doubtful they’ll be able to stem the demographic slide with this policy alone, but it shows the country is willing to make concessions to bolster their economy.

It took 30 years for Japan’s stock market to reach new highs. We complain when our market doesn’t reach new highs after two years. It just shows that exposures should be spread out and diversified. You never know what might pop and more importantly, what will hold up best in a down market.

India

India has benefited from the reshoring away from China. Many companies have, or have explored, set up manufacturing hubs in India. The business environment seems more friendly to foreign interests and the government seems more aligned with Western interests, relative to China.

Though we are underweight emerging markets, mainly due to China, we think there are opportunities if investors are selective.

There are plenty of places to allocate investment dollars outside of large US companies. It might sound crazy now, but the US stock market won’t always be the winner. Global markets jostle and shift constantly.

DISCLOSURES:

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

This document is for your private and confidential use only, and not intended for broad usage or dissemination.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. The principal risks of CWA strategies are disclosed in the publicly available Form ADV Part 2A.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. You cannot invest directly in an Index.

Past performance shown is not indicative of future results, which could differ substantially.

Consilio Wealth Advisors, LLC (“CWA”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where CWA and its representatives are properly licensed or exempt from licensure.