Market Update: Soft Landing? Hardly Even Knew You

Inflation, Stagflation, & Recession Odds

The mistake of the 1970s Fed was it eased off the brakes when rate hikes slowed the economy. That hesitation left the door open for inflation to continue to rise. Inflation was persistent even as the economy slowed, which is stagflation. No one wants stagflation. It wasn’t until the early 80s when rates pushed up to 12%, where inflation finally settled but the price paid was a recession.

We’ve never had a scenario where inflation went down without a recession. The current Fed tried to navigate a soft landing (cooling the economy without going into recession) by hiking rates with the plan of bringing them back down once inflation goes away. With Jay Powell’s latest comments, there’s little hope for a soft landing. We view this as encouraging because this Fed is aware of the lessons of the 70s.

I know it sounds crazy but we do need the economy to cool. When the markets rally in the face of this, it is saying it doesn’t believe the Fed. We need the credibility of the Fed to be cemented without doubts.

Prior to his speech in August, the market rallied from the June bottom, recovering 15%. This was not the expected outcome because we should be experiencing tighter financial conditions. Market rallies are welcome here but we think it might’ve been premature. Inflation is still high and it is coming down. The question of whether it’ll come down soon enough is not one we should wait around to find out. Fed intervention is needed here.

A couple of things related to the 1970s inflation aren’t as prevalent today. Labor unions and oil consumption were very different back then compared to today.

First, union representation was much stronger in the 70s when salary negotiations occurred frequently to keep up with the cost of living. A wage-price spiral prolonged inflation. We are not here to trash unions, it’s their bargaining power that had an unintended impact on inflation.

In this era, we aren’t seeing the type of wage growth that was much stronger in the 70s. Wage growth is slightly higher than the 50 year average, but that is expected when the labor market is so tight.

Since the 80s, union representation has been on the decline, reducing workers’ abilities to collectively bargain. It appears it has come to a head over the last few years, as workers fight to take some power back through the Great Resignation, Laying Flat, and Quiet Quitting. Even with all the job hopping, workers aren’t anywhere near experiencing the type of wage growth the occurred in the 70s.

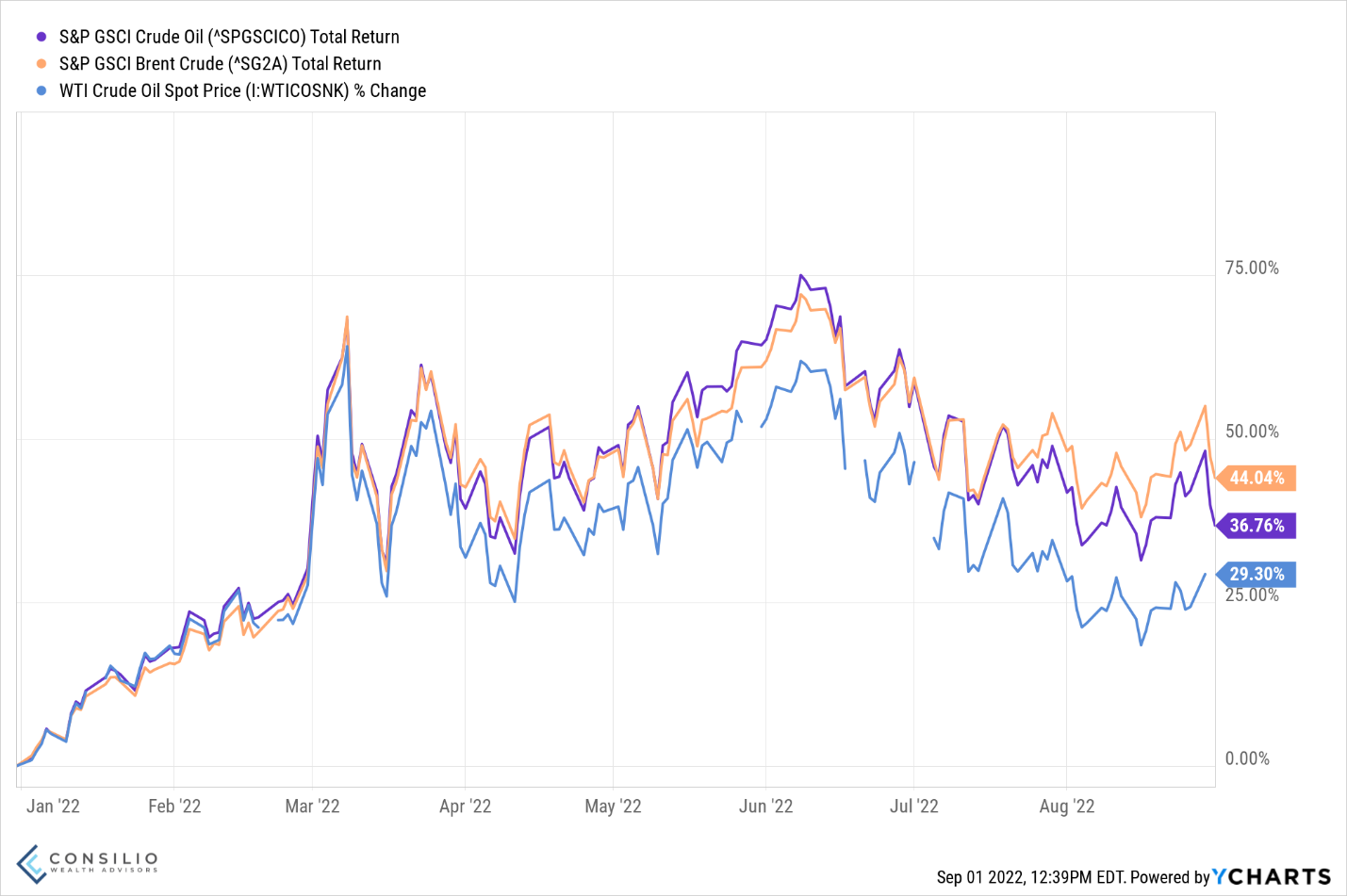

Second, oil prices were the big issue in the 70s. While we did experience an oil spike in 2022, our economy today is less reliant on oil. Cars and factories are much more efficient in using other means of energy.

Europe is facing an oil supply crunch because Russia supplies nearly 20% of the world’s oil. Even in spite of that, oil prices are headed towards a 3-month downturn as global demand is waning.

Given that what we’re experiencing today appears to be different from the 70s, we are seeing increased odds of a recession. Even as the economy cools, the Fed is going to be vigilant at keeping rates relatively high for an extended period. Stagflation is still a risk but the elements that caused the issues of the 70s don’t seem to be as big of factors now. There could be some unknowns that can surprise us - which is always the biggest risk.

Disclosures:

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Consilio Wealth Advisors, LLC (“CWA”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where CWA and its representatives are properly licensed or exempt from licensure.

Disclosures:

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Consilio Wealth Advisors, LLC (“CWA”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where CWA and its representatives are properly licensed or exempt from licensure.