Reaching Previous Highs

In hindsight, it was a red flag when sports stars opted to take their salaries in crypto. Given the history of bad financial decision-making among athletes, this should’ve been viewed as the tipping point. 78% of professional athletes go broke within three years of retirement.

I did not invest in any cryptocurrency, as my first foray into investing had a similar feel back in 1999. I’m also not here to say “I told you so” because I’ve been there 21 years ago. Thanks to FOMO and heightened speculation, cryptocurrencies aren’t the only thing that’s crashed recently. Dating all the way back to 2021, we started seeing unprofitable tech companies come down hard.

Money tends to find a home. When financial conditions are loose, those homes go from strong and sensible to shaky and speculative. When financial conditions tighten, the shaky investments tend to go first.

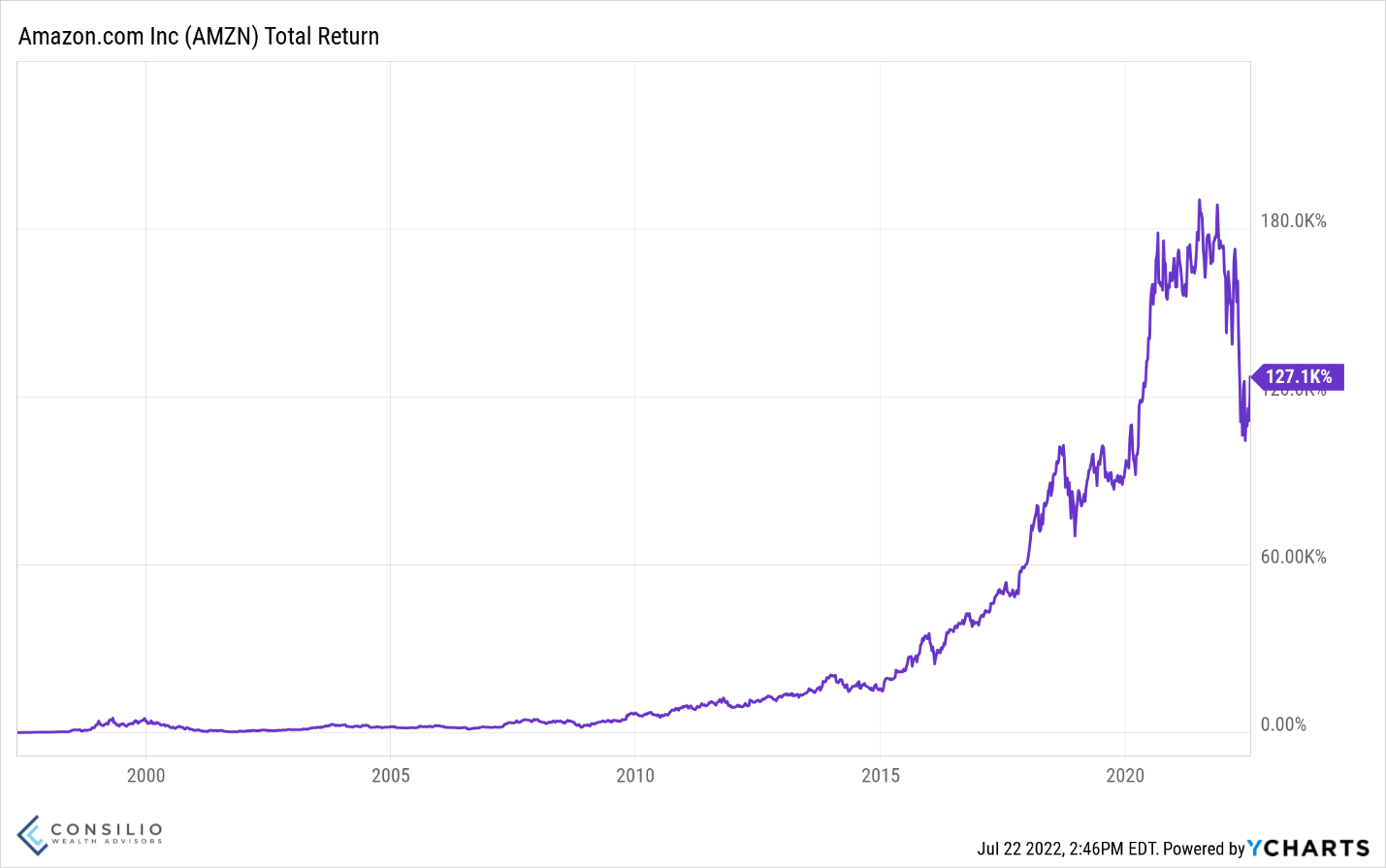

Some of these investments may come back from previous highs because there might be a legit business or technology hiding underneath. Amazon got swept up in 2001 because at the time, it was speculative tech without a pathway to profitability…at the time. It took more than 10 years to start showing flashes of the stock it is today. Innovation and disruption don’t happen overnight.

But for every one Amazon, there are hundreds of Webvans. Could one of the recently crashed securities be the next Amazon? Maybe. I would love to hear if you know because I for sure don’t.

I’ve mentioned before that there can be some speculation in most portfolios if it is scaled correctly. Meaning the higher risk won’t sink you when things go south.

When financial conditions start to loosen, which can take years, there might be an environment where speculation makes a comeback. Will crypto survive? That’s the risk of holding onto things like this. The other risk is if the rest of the market makes a comeback and the speculative holdings stay flat or continue to go down.

The cost of hope can be very high. Holding a single stock or asset, as opposed to an entire market or index, runs the risk of underperformance while the rest of the world moves on.

Find a way to be unanchored from the past. There’s no guarantee that any stock or asset will reach its previous highs (we’ve all seen the general disclaimer/reminder that “past performance is not indicative of future results…”). Hope is not an investment strategy.

The best investors throughout history have no emotional ties to their investments. Granted, the best fall back on institutional research and are playing a different game. But that doesn’t mean we can’t learn lessons from them.

Let’s look at single or concentrated stocks in general. This trap doesn’t just apply to speculative investments.

Five years ago, I met a GE retiree who had his retirement savings mostly in GE stock. The company match was in the form of GE shares which increased his concentration with each paycheck. He asked me what he should do and by that time GE’s glory days were long gone. I told him to move to the index and don’t look at GE stock again.

He kept his GE shares holding out hope for a recovery. He could’ve been right, and GE could’ve been the great stock it once was. My thinking was rooted in diversification, and I didn’t know if GE would continue to struggle like it has to this day. I just knew that spreading his bets would have increased his probability of success because he would own more potentially great companies. Albeit in smaller pieces.

Concentrated investments increase the odds of a boom or bust. Yes, some of your diversified investments will bust but proper diversification limits the damage. And it would be almost statistically impossible to have a diversified holding (like an index fund) to go to zero. Most importantly, growing broadly over time gives us the best chance of success.

Disclosures:

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. The principal risks of CWA strategies are disclosed in the publicly available Form ADV Part 2A.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

The hypothetical back tested performance shown is not indicative of future performance, which could differ substantially. It does not reflect actual account performance for any specific client or a composite performance for a group of clients. Model results represent what an investor’s returns might have been, had they been invested in the exact investments using the exact same allocation for the exact same time period for the model portfolio reflected. This does not reflect the impact that material economic and market factors may have had on decision making. You cannot invest directly in an index.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Consilio Wealth Advisors, LLC (“CWA”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where CWA and its representatives are properly licensed or exempt from licensure.