Why Diversified Portfolios Are Not Keeping Up with the S&P500

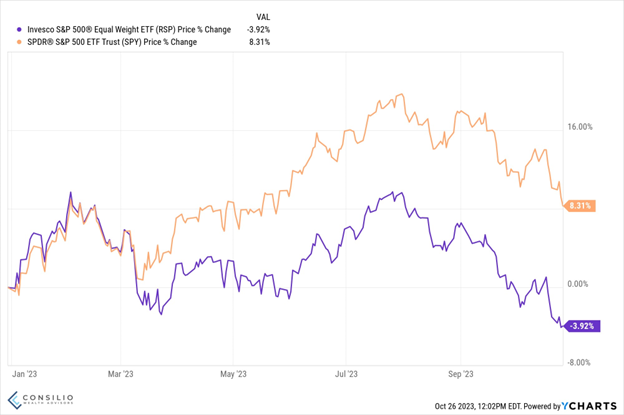

There’s ~12% gap between the S&P500 against the S&P500 Equal Weight ETFs as of October 26, 2023. The Equal Weight ETF reduces the impact of the top Magnificent 7 mega cap tech companies and reweights them to more value oriented and smaller sized companies. As you can see, giving more weight to 493 other names in the S&P500 shows the rest of the market has not had a good year.

Both ETFs hold the same companies, the difference being that the traditional S&P500 ETF is market cap weighted. Meaning the biggest companies by total market value carry the biggest weights in the S&P500. Apple’s market cap is $2.71 trillion and carries a market cap weight of 7.15% of the S&P500, as of the date of this writing. Now compare Blackrock, which carries a market cap of $91.36 billion. Blackrock’s weight in the S&P500 is 0.28%, as of the date of this writing.

If we invested $100 in the S&P500, $7.15 would go to Apple and $0.28 would go to Blackrock. Apple trades at $173/share as of 10/24/2023 and Blackrock trades at $613/share. The share price is less of a factor for the S&P500 because Apple is 30 times the size of Blackrock when looking at market cap or total size of the company. Market cap is calculated by taking the total number of outstanding shares times the current share price.

In the S&P500 Equal Weight ETF, Apple and Blackrock have the same weight, which is 1/500 or 0.02% each. By stripping out the weight of Apple in an index, investors can see performance of a market without outsized weightings of big companies.

Quick side note: Blackrock ($613) is more expensive than Apple ($173) on a per share basis. However, Blackrock is cheaper than Apple when it comes to the premium paid for profits. Blackrock’s price to earnings is 17, which means for every dollar of profit, investors are paying 17x for each share. Apple trades at 29x, meaning every dollar of profit will cost investors 29x.

The S&P 500 in most forms are cap weighted. The Dow Jones is price weighted. If Blackrock was part of the Dow, it would have three times the weight than Apple does. Price is determined by the number of shares available relative to company profits. So, comparing prices from one company to another is relatively arbitrary. It’s the premium paid for a share of the profits that matters more.

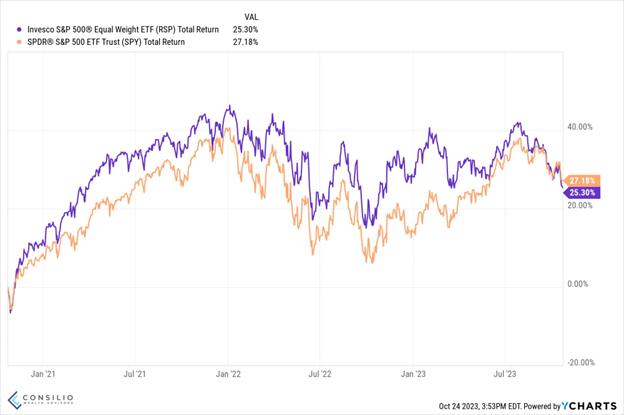

There are stretches where Equal Weight outperforms the traditional S&P500. This typically occurs in periods where medium and smaller sized companies within the S&P500 outperform large companies.

Smaller companies historically had a better chance of outperforming large companies. Especially after recessions.

When an economy enters an expansionary period, smaller companies tend to do better, historically speaking. The issue is what is considered expansion in this economy? We would have thought with all the rate hikes a recession would’ve hit by now. Every forecaster heading into this year has been wrong. Now there’s talk of a no landing scenario where the economy takes a breather and takes off again. It really is anyone's guess!

Diversified portfolios typically won’t hold 100% of the S&P500. There’s a mix of international companies, smaller US companies not part of the S&P500, and bonds. All of which are underperforming the S&P500 for the year, and all because the top 7 companies have rebounded from their lows of 2022. Investors should understand that the performance has been driven by only seven companies and that type of narrow performance likely isn’t repeatable year after year.

DISCLOSURES:

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

This document is for your private and confidential use only, and not intended for broad usage or dissemination.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. The principal risks of CWA strategies are disclosed in the publicly available Form ADV Part 2A.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. You cannot invest directly in an Index.

Past performance shown is not indicative of future results, which could differ substantially.

Consilio Wealth Advisors, LLC (“CWA”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where CWA and its representatives are properly licensed or exempt from licensure.